All Categories

Featured

Table of Contents

Approved investors have accessibility to financial investment chances that are supplied privately under Regulation D of the Stocks Act. These are not publicly used chances available to the basic spending public - investor individual. Typically, these investments could be riskier, but they use the opportunity for potentially greater returns. Historically, the SEC distinction was to mark people that are thought about to be much more advanced financiers.

Private business can use securities for financial investment that are not available to the public. These safety and securities products can include: Financial backing Funds (VC)Angel InvestingHedge FundsPrivate Equity OpportunitiesEquity Crowdfunding There are likewise additional personal investment safeties that can be accessed by recognized investors. The definition and needs of this sort of investor certification have continued to be top of mind because its creation in the 1930s.

Test To Become Accredited Investor

These requirements are intended to make certain that capitalists are well-informed enough to recognize the threats of these financial investment opportunities. They also function to guarantee that potential investors have enough wealth to protect versus monetary loss from riskier financial investments. Today, the criteria for recognized capitalists proceed to be a warm subject.

Others believe that accredited status needs to be based on their spending acumen. This will continue to be a hotly discussed subject among the economic group.

Non-accredited capitalists were first able to purchase the Fund in August 2020. Additionally, financiers may also consider purchasing Yieldstreet items with a Yieldstreet IRA. Accredited capitalists might take part in all our financial investment products with their Yieldstreet individual retirement account. Nevertheless, non-accredited financiers may only invest in the Yieldstreet Option Earnings Fund with a Yieldstreet IRA.

As for how much this will certainly influence the market moving ahead, it's most likely as well very early to inform. When more and a lot more competent financiers seek certification, it will certainly be less complicated to establish how this brand-new judgment has actually increased the market, if at all.

Net Worth Accredited Investor

Capitalists ought to meticulously think about the investment goals, threats, fees and expenses of the YieldStreet Alternative Income Fund prior to investing. The prospectus for the YieldStreet Alternative Revenue Fund has this and various other details about the Fund and can be gotten by referring to . The syllabus needs to read very carefully before purchasing the Fund.

The safety and securities explained in the program are not marketed in the states of Nebraska, Texas or North Dakota or to individuals resident or situated in such states (qualified investor form). No registration for the sale of Fund shares will be accepted from any individual homeowner or situated in Nebraska or North Dakota

An accredited financier is an individual or entity that is allowed to buy protections that are not signed up with the Securities and Exchange Commission (SEC). To be a recognized financier, a specific or entity must fulfill certain revenue and web worth guidelines. It takes cash to generate income, and approved investors have extra possibilities to do so than non-accredited capitalists.

Accredited capitalists are able to spend cash directly right into the lucrative world of exclusive equity, exclusive positionings, hedge funds, financial backing, and equity crowdfunding. However, the requirements of who can and who can not be an approved investorand can take part in these opportunitiesare figured out by the SEC. There is an usual misunderstanding that a "process" exists for a specific to come to be a certified financier.

What Is Accredited Investor

The worry of verifying a person is a recognized financier drops on the investment vehicle as opposed to the capitalist. Pros of being an approved financier include accessibility to special and limited investments, high returns, and increased diversification. Disadvantages of being a recognized financier consist of high danger, high minimum investment amounts, high costs, and illiquidity of the financial investments.

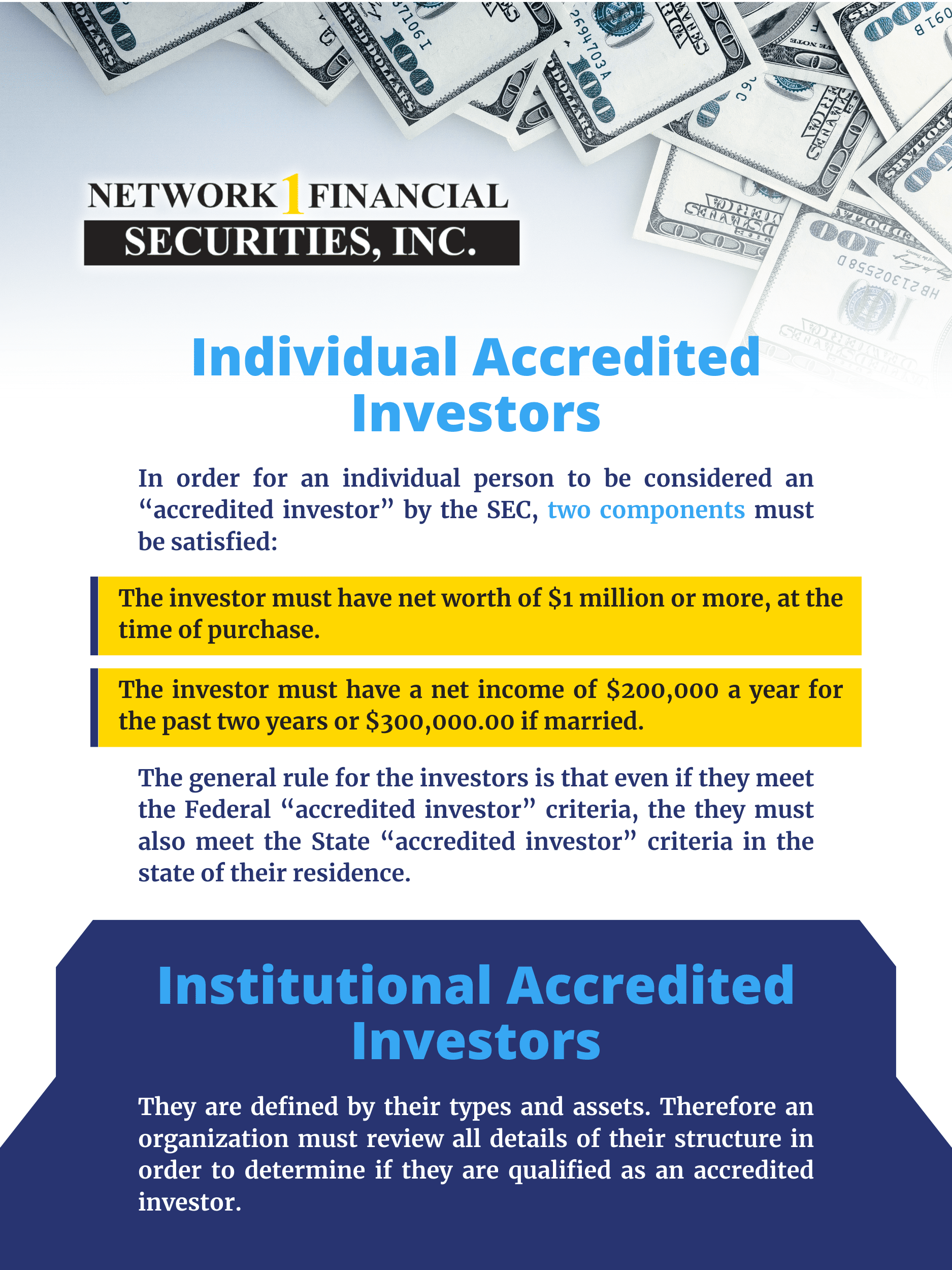

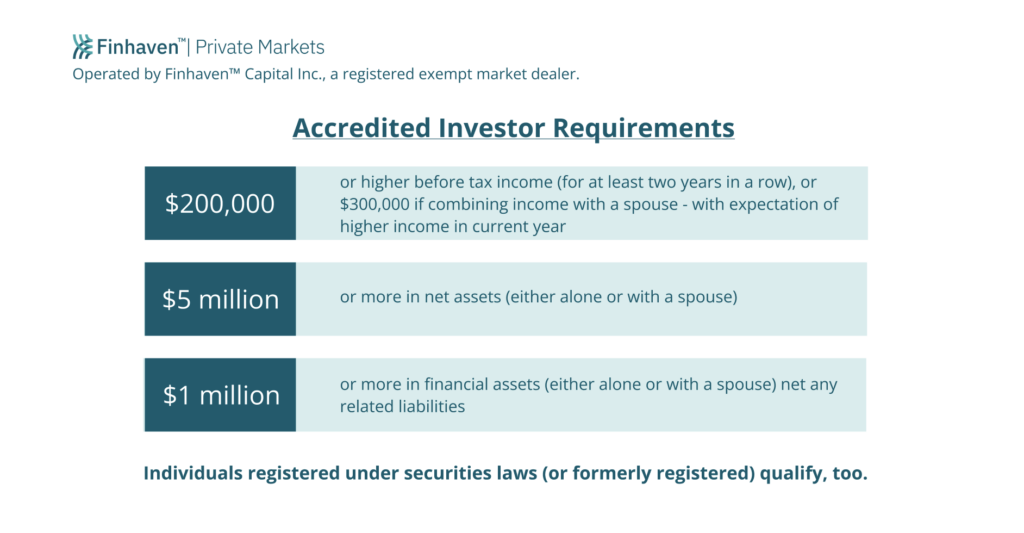

Policy 501 of Regulation D of the Stocks Act of 1933 (Reg. D) provides the definition for an accredited financier. Put simply, the SEC specifies an accredited financier via the boundaries of earnings and total assets in two means: An all-natural person with revenue exceeding $200,000 in each of both most recent years or joint income with a spouse exceeding $300,000 for those years and a sensible expectation of the same revenue degree in the present year.

Roughly 14.8% of American Homes certified as Accredited Investors, and those families regulated about $109.5 trillion in wide range in 2023 (accredited investor self certification). Measured by the SCF, that was around 78.7% of all personal riches in America. Policy 501 also has arrangements for firms, partnerships, philanthropic companies, and count on enhancement to company directors, equity proprietors, and banks

The SEC can add accreditations and designations moving forward to be consisted of along with encouraging the general public to submit proposals for other certificates, classifications, or qualifications to be considered. Employees who are considered "experienced employees" of a private fund are currently likewise thought about to be approved financiers in concerns to that fund.

Individuals who base their credentials on yearly earnings will likely require to send tax obligation returns, W-2 kinds, and other papers that indicate salaries. Individuals may additionally take into consideration letters from reviews by Certified public accountants, tax obligation lawyers, financial investment brokers, or advisors. Recognized financier classifications additionally exist in various other countries and have comparable requirements.

Investor Certificate

In the EU and Norway, for instance, there are 3 tests to establish if an individual is a certified capitalist. The initial is a qualitative test, an examination of the individual's experience, knowledge, and experience to determine that they are qualified of making their own financial investment decisions. The 2nd is a measurable test where the person needs to meet 2 of the adhering to criteria: Has performed transactions of considerable size on the pertinent market at an average regularity of 10 per quarter over the previous four quartersHas a financial portfolio going beyond EUR 500,000 Works or has operated in the economic sector for a minimum of one year Last but not least, the customer has to state in written type that they want to be treated as a specialist client and the firm they wish to associate with should notify of the securities they could lose.

Pros Accessibility to more financial investment possibilities High returns Raised diversity Cons Risky investments High minimum investment amounts High efficiency costs Long funding secure time The main advantage of being a recognized capitalist is that it gives you an economic benefit over others. Due to the fact that your total assets or income is currently among the greatest, being a certified financier allows you access to investments that others with much less riches do not have accessibility to.

Foreign Accredited Investor

These financial investments might have higher rates of return, much better diversity, and numerous various other characteristics that aid build riches, and most importantly, build riches in a much shorter time frame. Among the simplest examples of the advantage of being a certified investor is having the ability to purchase hedge funds. Hedge funds are primarily only accessible to certified financiers since they require high minimal investment quantities and can have higher associated risks however their returns can be remarkable.

There are likewise cons to being an accredited capitalist that connect to the financial investments themselves. The majority of financial investments that need a specific to be an accredited financier included high risk. The techniques utilized by several funds featured a higher threat in order to achieve the goal of beating the marketplace.

Accredited Investors Crowdfunding Sites

Just transferring a couple of hundred or a few thousand dollars right into an investment will refrain. Accredited financiers will certainly need to devote to a few hundred thousand or a couple of million bucks to partake in financial investments suggested for certified capitalists (real estate crowdfunding accredited investors). If your financial investment goes southern, this is a whole lot of money to lose

These mainly come in the kind of efficiency fees along with monitoring charges. Efficiency fees can range in between 15% to 20%. Another disadvantage to being an accredited investor is the ability to access your financial investment capital. For instance, if you purchase a couple of supplies online via a digital platform, you can draw that money out any kind of time you such as.

A financial investment car, such as a fund, would have to identify that you certify as an accredited financier. The benefits of being an approved financier include accessibility to special financial investment possibilities not available to non-accredited investors, high returns, and increased diversification in your portfolio.

In certain areas, non-accredited investors likewise deserve to rescission. What this suggests is that if a capitalist determines they wish to pull out their money early, they can claim they were a non-accredited capitalist the entire time and get their money back. It's never ever a good concept to give falsified documents, such as phony tax returns or monetary statements to a financial investment lorry just to spend, and this might bring lawful difficulty for you down the line.

That being stated, each deal or each fund might have its very own limitations and caps on investment amounts that they will approve from an investor. Certified financiers are those that satisfy particular needs concerning revenue, qualifications, or web well worth.

Table of Contents

Latest Posts

Homes Delinquent Tax Sale

Houses That Need Taxes Paid

Houses For Sale Taxes Owed

More

Latest Posts

Homes Delinquent Tax Sale

Houses That Need Taxes Paid

Houses For Sale Taxes Owed